WHY CURRENCY ANALYSIS ?

Learn Currency Market Earn Passive Income For Lifetime |

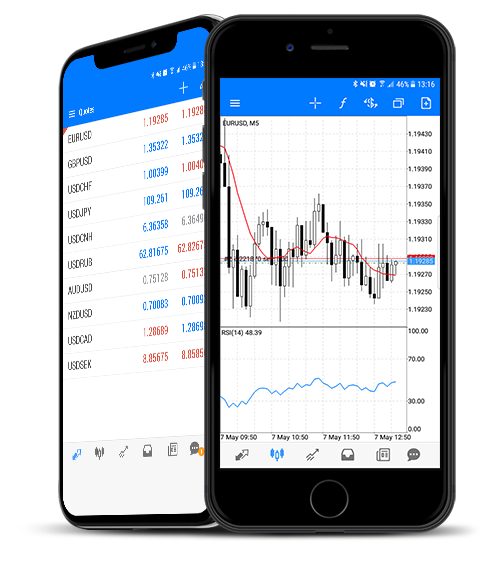

Making Your Daily Trading Easy and Trading Insights With

Currency Analysis...

Currrency Analysis

Empower Your Currency Trading

|

Currency Analysis, also known as technical analysis, is a method of analyzing financial markets by examining historical price and volume data to identify patterns and trends that might predict future price movements. It helps traders make informed decisions by using tools like trendlines, chart patterns, and indicators to visualize and interpret market behavior.

Key aspects of trading chart analysis:

Identifying Trends:

Charts help visualize price movements over time, allowing traders to identify uptrends, downtrends, and sideways trends.

Recognizing Patterns:

Specific chart patterns, like head and shoulders, double tops/bottoms, and pennants, can signal potential trend reversals or continuations.

Using Indicators:

Various indicators, such as moving averages, RSI, and MACD, are used to analyze momentum, overbought/oversold conditions, and other market signals.

Understanding Support and Resistance:

Support and resistance levels represent price points where buyers and sellers are likely to enter or exit the market, influencing price movement.

Analyzing Volume:

Trading volume provides insights into the strength of price movements and can confirm or contradict price patterns.

Timeframes:

Different timeframes (e.g., 5-minute, daily, weekly) allow traders to analyze price action at different scales, helping them identify short-term and long-term trends.

Steps to interpret a trading chart:

1.Identify the chart type: Common chart types include line charts, bar charts, and candlestick charts.

2.Choose the timeframe: Select the appropriate timeframe based on your trading strategy and goals.

3.Observe the direction of price movement: Note whether the price is trending upwards, downwards, or sideways.

4.Check trading volume: Analyze the volume to confirm price trends and assess the strength of price movements.

5.Identify support and resistance levels: Determine potential areas of support and resistance on the chart.

6.Look for chart patterns: Identify recognizable patterns like head and shoulders or double tops/bottoms.

7.Use technical indicators: Apply relevant indicators to gain further insights into market conditions.